Telcos struggle to deliver on the digitalisation dream

Telcos talk a good game when it comes to the digitalisation of the enterprise, but when it comes to actually delivering on the promise, they have been found wanting.

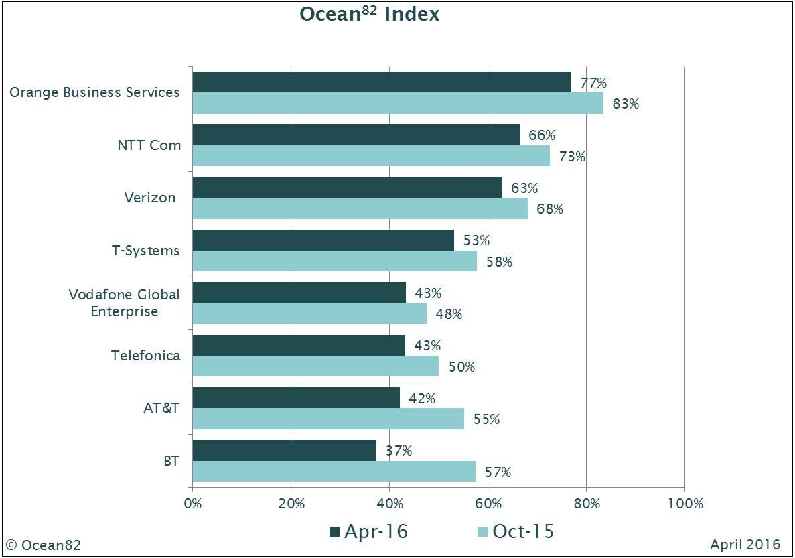

This is one conclusion put forward in a recent study by Ocean82. The consultancy generated a score based on an assessment of end-user perception of their telco's brand, VPN and related services capabilities, and overall level of service, which includes factors like value for money, and the day-to-day relationship with their service provider, among others.

The world's biggest global service providers were weighed, measured, and ranked by this study, and the results are not great.

Ocean82 found an overall drop in scores across the board during the six months to April. Orange Business Services held onto top spot with a score of 77%, but it was down from 83% in October 2015. Second-placed NTT Communications scored 66%, compared to a previous score of 73%, while Verizon came in third with 63%, down from 68%. BT saw the biggest fall: its Ocean82 score fell to 37% from 57%.

"The digital transformation seems to raise expectations about an improved customer experience but there is little evidence of any marked improvement in user perception," remarked Ocean82 director Janet Watkin.

"On the contrary, it seems users are becoming less satisfied overall," she said.

Part of the reason for this, Watkin suggested, is that becoming more customer-focused is a long and complex process for a telco, and the effects are being felt by their users.

"Most global service providers believe that creating a positive customer experience should be a higher priority than marketing communications when it comes to brand building, but they are finding this very hard to achieve in reality," she said.

"The sheer level of change observed among global providers is hard to manage. Entrenched attitudes are difficult to shift," she continued. "The evolution from a technical and/or product standpoint, to a customer-centric standpoint requires behavioural changes and these often lag behind the rhetoric of senior managers."

It isn't just operators that have their work cut out trying to improve their standing with customers. As of this week, Samsung has some major work to do if it is to repair the damage to its reputation wrought by its combustible Galaxy Note 7.

With reports that replacement devices were suffering from the same battery issue that caused original models to burst into flame, Samsung on Tuesday pulled the plug, permanently halting sales and production of its flagship smartphone.

A day later, Samsung slashed its third quarter financial outlook, and by Friday it had also cut its forecast for the next two quarters as well.

However, the direct financial impact of killing off the Galaxy Note 7 pales into insignificance compared to the potential long-term damage to Samsung's brand.

According to a research note from ratings firm Fitch, covering the cost of the debacle is unlikely to affect the South Korean electronics giant's credit rating.

"The benefits of Samsung's diversified product portfolio have reduced its vulnerability to this shock," Fitch said.

"However, the problems with the Note 7 have raised long-term uncertainty about Samsung's handset operations, as the issues with the flagship model have highlighted weaknesses both in R&D capabilities and the company's capacity to efficiently remedy serious hardware defects," the ratings firm continued, suggesting that customers may consider switching to Apple or a rival Android phone maker.

"Industry experience, such as the decline of Nokia and BlackBerry, shows how successful manufacturers can lose market share particularly quickly in the handset business. This is due to the fast pace of technological change and the frequency with which many consumers change their handsets," Fitch warned.

Also in telecoms this week, there were 5G tests from Telia and U.S. Cellular; Ericsson issued a third quarter profit warning; the CEO of Telefonica Brasil handed in his resignation; Rcom agreed a new deal to offload its towers business; and the GSMA warned that the Netherlands' stricter net neutrality rules put the Digital Single Market (DSM) at risk.

Meanwhile, Orange Egypt reportedly applied for a 4G licence after the country's telco watchdog offered new terms; Sprint signed another sale and leaseback deal in a bid to raise $3.5 billion; Sky UK revealed the progress it has made towards launching its MVNO service; and Vodafone joined the recently-launched 5G Automotive Association (5GAA).

Totaltele.com