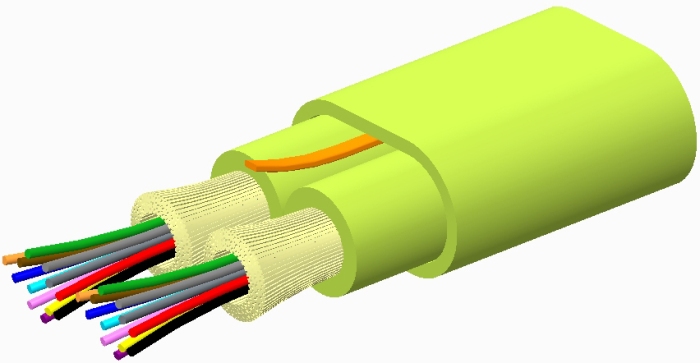

Fiber infrastructure investment to touch $144 bn between 2014-19

The report called Trends in Telecommunication Reform 2016 said more than 40 operators have launched or are planning LTE-A deployments worldwide; 88 percent of these operators are in developed markets.

The rise in consumer data consumption may boost more Wi-Fi investment.

Existing operators, new entrants and financiers are developing alternative funding approaches for broadband network investments.

Investment in broadband infrastructure is also coming from more unlikely institutions such as hedge funds or corporates that do not traditionally invest in telecoms infrastructure.

Network Sharing

When network coverage becomes less of a competitive differentiator, operators may need to consolidate networks (through network sharing) as a means of moving away from infrastructure investment and towards developing innovative services.

Governments currently allocate spectrum mainly on a dedicated basis. New dynamic spectrum access (DSA) technologies allow devices to use spectrum where it is not being used in a particular geographic area, or at a particular time.

Network sharing can have many benefits but is not without risks, which can include: reduction in competitive intensity; potential for collusive dealing and information sharing; and reduced options for services-based competitors.

IoT

There will be 1 – 2 billion M2M connections by 2020, according to GSMA. Some experts believe that the market for IoT devices will grow exponentially, resulting in over $1.7 trillion in value added to the global economy by 2019.

The simplest IoT technology — passive RFID tagging — is widespread in retail, transit ticketing and access control. Near-Field Communication (NFC) is now included in newer smart phones, enabling applications such as contactless payments.

Complex M2M systems can send information over cellular networks. Examples include electricity meter readings sent to energy companies and car airbag deployment notifications sent to emergency services.

Telecomlead.com