VoLTE subscriber base, revenue revealed by IHS

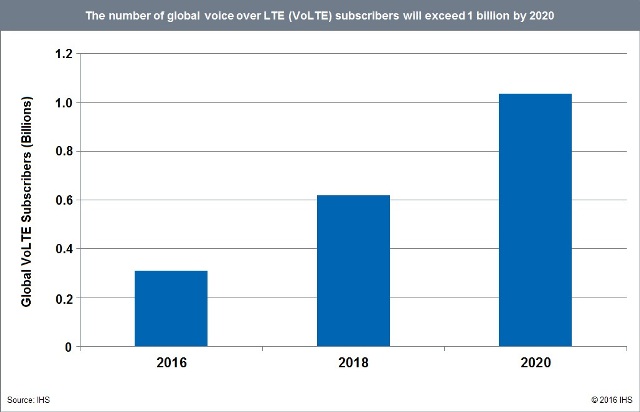

The VoLTE subscriber base is forecast to touch 1 billion by 2020 from 185 million in 2015.

The VoLTE subscriber base will increase to 310 million in 2016.

VoLTE service revenue is projected to reach $6.3 billion by 2020. IHS Technology did not reveal the revenue from VoLTE services in 2015.

Most of the 185 million VoLTE users in 2015 came from Japan, South Korea and the US, while the growth in VoLTE user base in 2020 will be supported by China Mobile’s VoLTE migration. China Mobile is the largest telecom network operator in the world — based on mobile subscriber base.

Though India has telecom operators such as Bharti Airtel, Idea Cellular, Vodafone India and Reliance Jio Infocomm are making investment in LTE space, they do not have immediate plans to launch VoLTE services.

Globally, telecom network operators launched 40 VoLTE commercial networks in 2015. They started 23 VoLTE networks in the first four months of 2016 as in all of 2014.

The telecom analysis report from IHS noted that VoLTE is quickly ramping up, with improvements in network efficiencies and spectrum reuse as the main drivers.

According to IHS estimates and those of the Global Mobile Suppliers Association (GSA), there are currently 63 VoLTE commercial networks. This is a net addition of 23 VoLTE networks to the existing 40 that were online at the end of December 2015.

In each of the currently operational 63 VoLTE networks, existing subscribers become de facto VoLTE users when they upgrade their devices to LTE-capable ones.

Verizon Advanced Calling (VoLTE) service is device driven. Users do not sign up for Advanced Calling, but if they buy a device that supports VoLTE, then they are on the VoLTE network. For the majority of those VoLTE networks, the service is marketed as a device feature rather than something to which a user subscribes.

There are 500 commercial LTE networks in the world, and every single network will eventually support VoLTE, as it is inevitable that voice will go to LTE.

VoLTE challenges

However, making VoLTE work perfectly with no glitches remains challenging, and service providers know they need to achieve a degree of LTE network ubiquity and then beef up their IP multimedia subsystem (IMS) infrastructures to fully support VoLTE. But in the meantime, the VoLTE frontrunners are ramping up VoLTE users.

By 2020, VoLTE service revenue is projected to reach $6.3 billion, with almost half coming from North America, where average revenue per user (ARPU) is the highest in the world. At that time, Asia Pacific will have three times more VoLTE users than North America but revenue will be 13 percent lower.

As VoLTE continues to surge, the need for roaming becomes greater, giving rise to VoLTE roaming as the next big thing to come — and fuelling the debate over local breakout (LBO) versus S8 home routing (S8HR).

Telecomlead.com