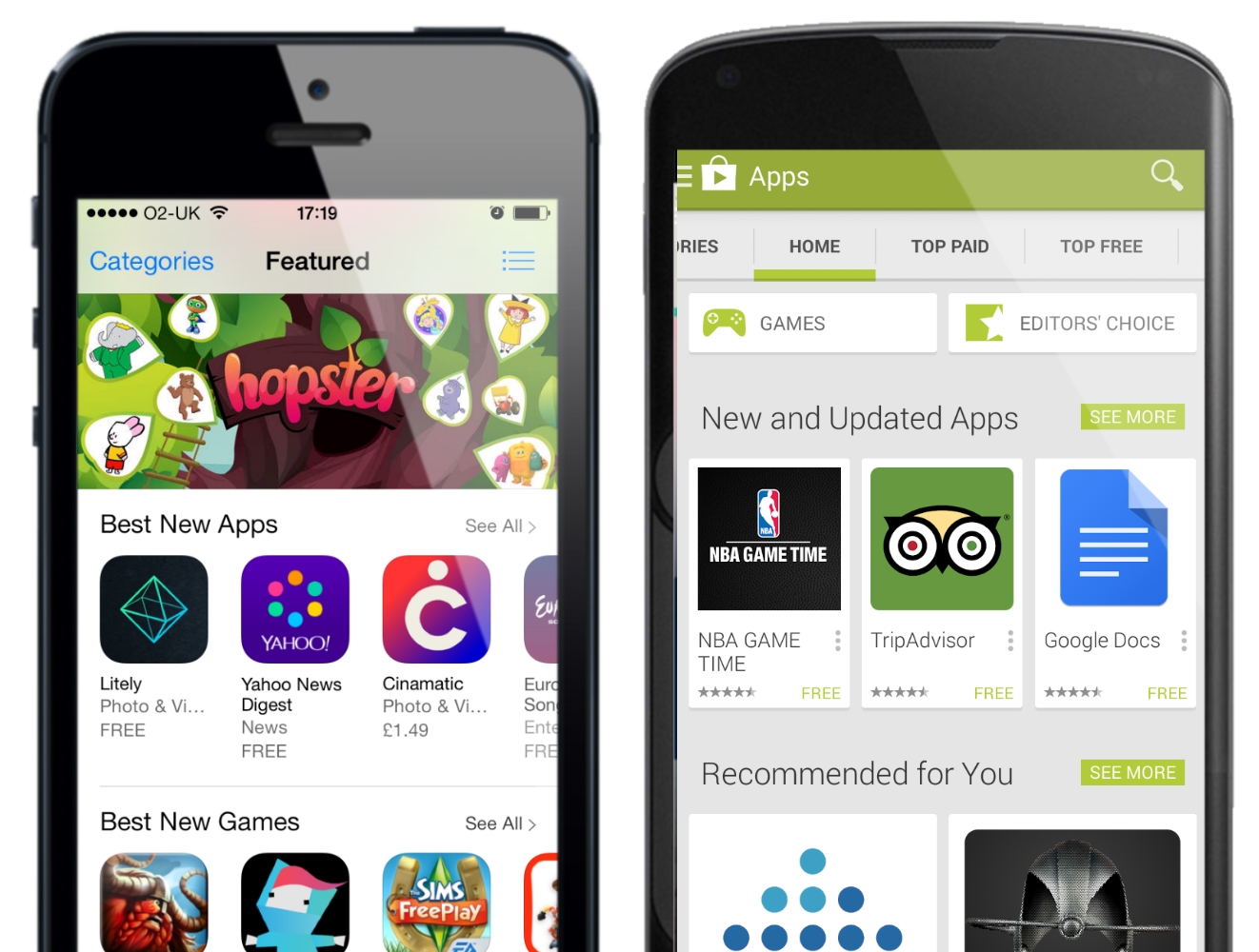

Google, Apple to up app revenue share to developers

“Instead of keeping 70 per cent of all revenue generated from subscriptions, publishers will be able to keep 85 per cent of revenue once a subscriber has been paying for a year,” a report on technology website Re-Code said on Thursday.

However, there’s one big difference between the announcements of both the companies. For Apple developers, the split will only be given after a consumer has been subscribing to a service for more than a year.

But unlike Apple, instead of requiring developers to rope in a subscriber for 12 months before offering the better split, Google will release the money right away, reports IANS.

IDC says Apple is expected to continue outperforming Google Play in terms of revenue generation. However both ecosystems are more than sufficiently established to sustainably attract developers.

Mobile device users installed nearly 156 billion mobile applications in 2015, generating $34.2 billion in direct (non-advertising) revenue, said IDC.

Mobile applications revenue will grow to more than 210 billion installs and nearly $57 billion in direct revenue in 2020.

The number of mobile applications will experience a five year compound annual growth rate (CAGR) of 6.3 percent.

Apple’s App Store has nearly 58 percent (+36 percent) of global direct app revenue in 2015. Apple’s share of global apps market was 15 percent (–8 percent). Google Play captured about 60 percent of install volume and nearly 36 percent of direct revenue in 2015.

Ovum says mobile app revenue will grow 2.2 times over the next five years, from $36 billion in 2015 to $79 billion in 2020. This is compared to a 1.8 times increase in the number of app downloads – from 211 billion in 2015 to 378 billion in 2020.

Mobile app downloads will however see a marked slowdown in mature smartphone markets as they approach saturation and as user acquisition costs escalate, placing a greater emphasis on download quality rather than quantity.

Emerging markets will register the steepest growth rate over the next five years in both downloads and revenue – twice as steep as developed markets in the case of the latter. Yet developed markets will continue to capture the largest share of revenue from mobile apps.

Telecomlead.com